Introduction: Startups thrive on innovation and opportunity, but the pathways to success vary dramatically across regions. This post focuses on comparing the average funding sizes, differences in investment amounts, and the VC landscapes in the US, Japan, and SEA, revealing insights for your business strategy.

Key Points:

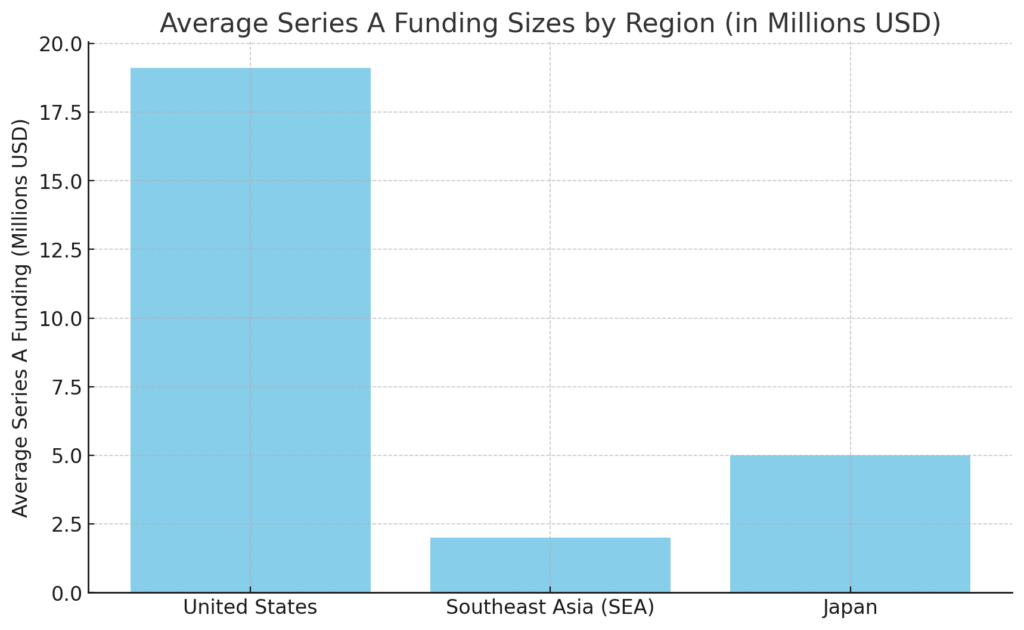

- Average Funding Sizes:

- United States: The average funding size for startups is significantly larger due to the mature VC market. Series A rounds often reach $10M+, with the median Series A funding peaking at $14M and the average at $19.1M as of 2022. In 2023, these figures adjusted slightly to a median of $12M and an average of $18.7M. (Source)

- Japan: Startups receive moderate funding, with Series A rounds typically ranging from $1M to $5M, reflecting a more cautious investment culture. In 2023, Japanese startups collectively raised approximately ¥753.6 billion (around $6.9 billion USD). (Source)

- SEA: Funding amounts vary widely. Early-stage funding often ranges from $500K to $2M, driven by a mix of local and international investors. Series B rounds are typically between $10M and $20M, especially in markets like Singapore and Indonesia. (Source)

- Differences in Investment Amounts:

- United States: High-risk, high-reward investments dominate, with a focus on disruptive technologies and rapid scalability. Notable recent examples include OpenAI’s $6.6 billion funding round, elevating its valuation to $157 billion (Source) and Databricks’ $9.5 billion raise, valuing it at over $60 billion. (Source)

- Japan: Conservative investments prioritize stability and alignment with corporate goals, often through strategic partnerships. Specific large funding rounds are less publicly disclosed, reflecting the market’s cautious nature. (Source)

- SEA: Smaller ticket sizes are common, with an emphasis on sustainability and regional impact. Recent examples include Aspire’s $100 million Series C round and Holmusk’s $45 million Series B round in Singapore. (Source)

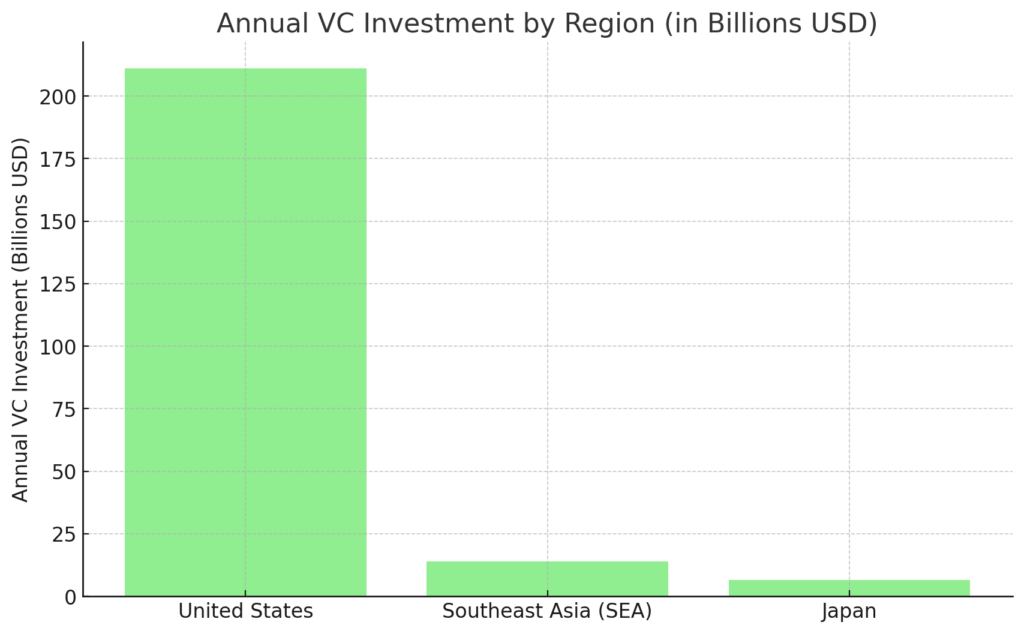

- VC Market Landscape and Size:

- United States: Hosts the largest and most developed VC ecosystem globally, valued at approximately $211 billion in annual VC investments as of 2023. The US accounts for around 50% of global VC funding. (Source)

- SEA: An emerging VC market with a total market size of approximately $14 billion in annual investments. The region’s VC activity is fueled by its growing digital economy and a high concentration of startups in Singapore, Indonesia, and Vietnam. (Source)

- Japan: The VC market size is relatively smaller but steadily growing, with investments reaching $6.5 billion annually. Corporate venture capital and government-backed funds are key drivers of this growth. (Source)

- Key Figures:

- United States: $211 billion annual VC investment, 50% of global VC funding.

- SEA: $14 billion annual VC investment, highlighting its rapid growth as a hub for technology and sustainability-focused startups.

- Japan: $6.5 billion annual VC investment, heavily driven by corporate VCs.

Conclusion: Understanding the funding dynamics and VC landscapes in these regions can shape your startup’s approach to securing capital. The US offers access to substantial capital for high-growth ventures, SEA presents a rapidly growing market with diverse investment opportunities, and Japan provides a stable environment with corporate partnerships. Tailoring your funding strategy to align with these regional dynamics is essential for success. With expertise across these ecosystems, I can help you navigate these challenges and align your funding strategy with market realities.